Credit Building Credit Cards are designed for people with limited or no credit history. Using these cards responsibly can demonstrate your ability to handle credit, thereby gradually improving your credit score. This is crucial for future applications for loans to purchase cars or for mortgage loans to buy houses.

Introducing the Zilch Credit Card, which has many attractive features. Firstly, Zilch offers responsible credit limits, suited to the needs of each user. Users can choose from a variety of flexible payment methods. Zilch can also help improve your credit score, as long as you make repayments on time. When shopping, users can also enjoy a 0.5% cashback. These are the main selling points of the Zilch Credit Card, which will be helpful to everyone.

📈 Improve credit score

💷 Apply now and receive a £5 reward

🛍️ 2% cashback from large physical stores (Lidl, Selfridges, Primark, Apple, Hotel Chocolat, Matalan etc)

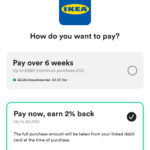

🛍️ 2% cashback from well-known online retailers (Amazon, Ikea, Currys, Booking.com, Nike, and Zooplus)

💵🔙 0.5% cashback on every purchase

💷 Earn £5 using this application link: https://zilch.onelink.me/sOUJ/s97dewk8

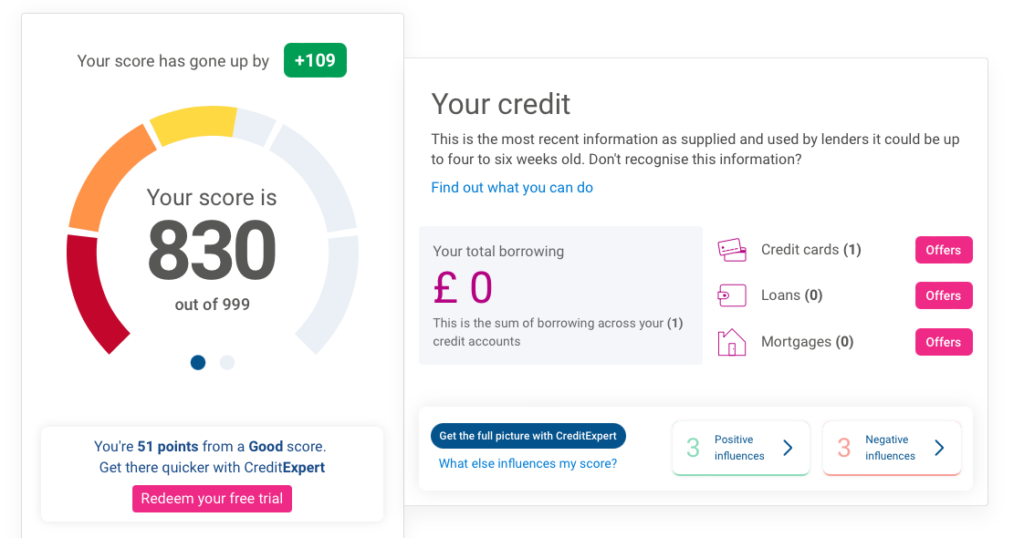

Astounding credit score increase, 109 points in one month

In November 2023, my credit score from Experian surprisingly soared by 109 points within a month. This increase occurred after I started using a new credit card. This significant growth might be due to the fact that last month I applied for a credit card and opened a new bank account. It seems that using a credit card wisely indeed has significant benefits for my credit score.

When I applied for the credit card, my credit score at Experian was 721.

Please download the app. You can register using your driving license or passport. You also need to link a savings card to the app. When you use the credit card, the amount will be directly deducted from the linked savings card.

You can add this card to Apple Pay, and you will receive a 0.5% cash rebate on all purchases.

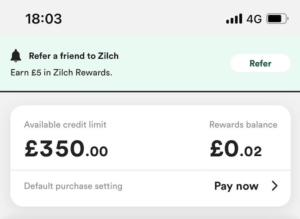

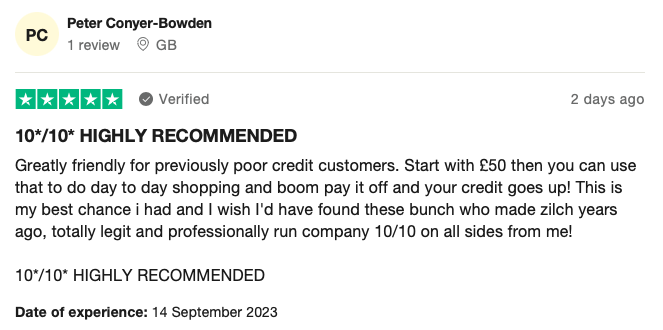

They will initially assign you a credit limit, starting from £50. For example, I was assigned a credit limit of £350.

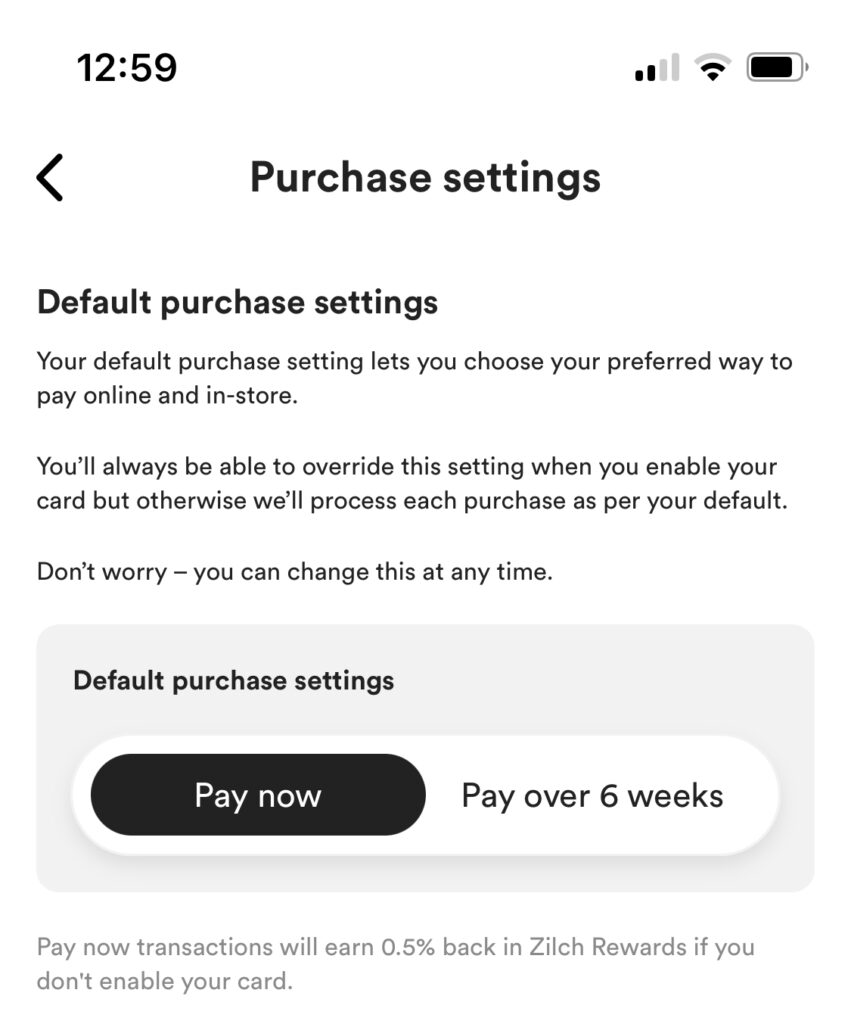

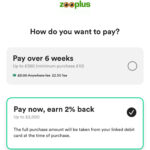

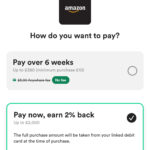

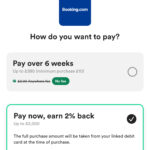

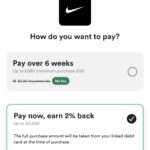

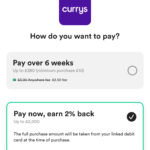

There are two ways to repay the credit card: ‘Pay Now’ or ‘Spread over 6 weeks’. If you intend to improve your credit score, I recommend using the ‘Pay Now’ option.

💷 Earn £5 using this application link: https://zilch.onelink.me/sOUJ/s97dewk8

2% cashback from well-known online stores

Zilch credit card offers users up to 2% cashback when shopping at multiple renowned online stores such as Amazon, IKEA, Currys, Booking.com, Nike, and Zooplus. Zilch users can enjoy up to 2% cashback when shopping at these participating online stores. Whether it’s updating home decor with IKEA furniture, booking travel accommodations through Booking.com, purchasing the latest technology products on Amazon, choosing sports gear at Nike, or even buying supplies for pets at Zooplus, Zilch brings additional rewards for every purchase you make.

What is Zilch

Zilch is an innovative payment platform based in London and is the fastest company in Europe to achieve the status of a double unicorn. As of 2023, it has over 3 million users. Zilch collaborates with the globally renowned credit information agency, Experian, and both parties report credit information to each other in the BNPL (Buy Now Pay Later) sector.

How does Zilch affect your credit score?

Zilch feeds your transaction information back to credit reference agencies — meaning if you miss any payments, your score could potentially drop. The longer the overdue period, the worse the situation becomes. Therefore, it’s always important not to borrow more than you can comfortably afford and to repay any unpaid debts as soon as possible.

The good news is, if you clear all credit payments on time — including those with Zilch and any other credit providers — you may see your credit score improve over time.

What happens to my credit score if my Zilch credit card application is unsuccessful?

When you join Zilch, Zilch performs an affordability check to see if it can pre-approve you. If Zilch cannot approve you, it will only conduct a soft inquiry (Soft Search), which has no impact on your credit score. If you decide to join Zilch and accept a credit agreement, Zilch will conduct a hard inquiry (Hard Search) to let the credit reference agencies know. This will appear on your credit report. But the most important thing to remember is to make repayments on time — failing to make payments will affect your credit score.

💷 Earn £5 using this application link: https://zilch.onelink.me/sOUJ/s97dewk8

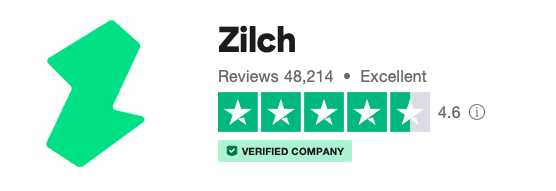

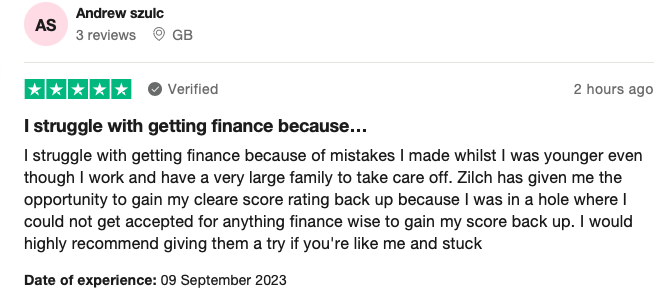

They have good reviews on trustpilot:

💷 Earn £5 using this application link: https://zilch.onelink.me/sOUJ/s97dewk8