Yes, in the UK, if you are purchasing a second property, you will generally be required to pay higher rates of stamp duty land tax (SDLT) than if you were purchasing a primary residence.

Since April 2016, an additional 3% surcharge has been added to the standard SDLT rates for purchases of additional residential properties, such as second homes or buy-to-let properties.

For example, if you are buying a second property in the UK for £300,000, you would pay 3% on the first £125,000, 5% on the portion between £125,001 and £250,000, and 8% on the remaining amount above £250,000. This would amount to a total stamp duty bill of £14,000, compared to the £5,000 you would pay if it were your primary residence.

It’s important to note that there are some exceptions to this rule, such as if you are replacing your main residence or if you are purchasing a property jointly with someone who is not a homeowner.

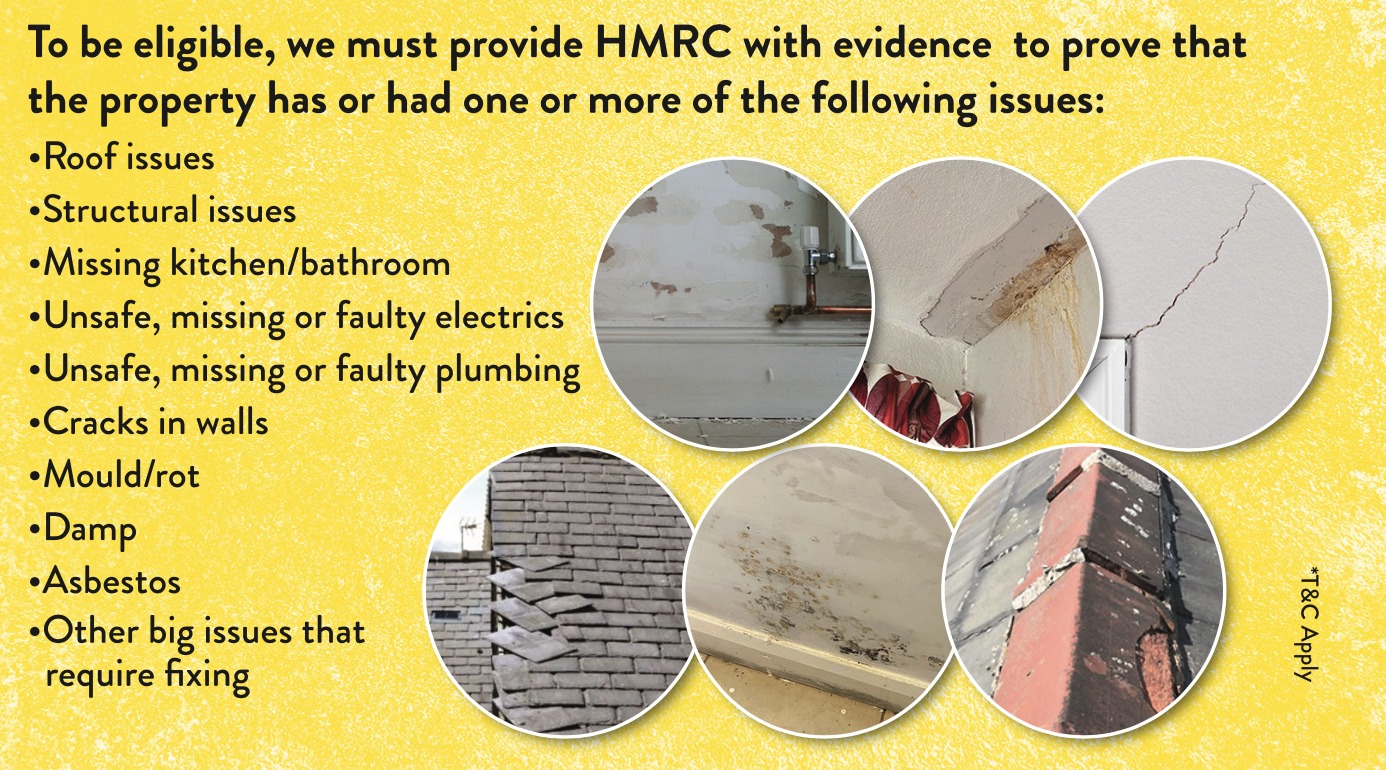

There are also few conditions below to be entitled for the claim:

1. The house has to be an additional house in the UK (Not the first house in the UK)

2. The house bought within 4 years

3. Found some issues in the house which are affecting the living

Contact us now via whatsapp: https://wa.me/447476926233

Our Facebook and Whatsapp Groups: https://livinintheuk.com/archives/42/

It’s always best to seek advice from a professional if you’re unsure about your stamp duty liability.